In 1695, the Bank of Scotland was incorporated by an act of the first Scottish Parliament.

Scottish Banking History

An article about Scottish banking history might seem a rather odd subject for a travel website.

However, the fascinating history of the Bank of Scotland and the Royal Bank of Scotland says so much about the history of Scotland.

The Bank of Scotland was incorporated by an act of the first Scottish Parliament in 1695

The cornerstone on which Scotland’s modern banking system is based was put into place on July 17, 1695, when the Bank of Scotland was incorporated by an act of the Scottish Parliament.

It is the only institution founded by the first Scottish Parliament that still exists today, albeit as part of a larger banking group. The Bank’s head office remains on the Mound, Edinburgh

English merchant John Holland proposed the foundation of the Bank of Scotland

Much of the credit for the launch must go to Englishman John Holland. Although there is little surviving information about him we know he was born in London in 1658, educated in Holland, with a seafaring father who was a friend of diarist Samuel Pepys.

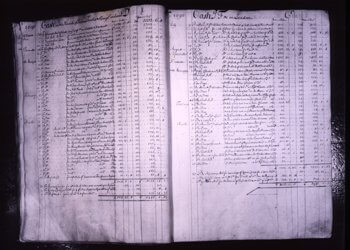

In order to raise the necessary capital, a subscription book managed by Alexander Campbell was placed in the Cross Keys Tavern in Edinburgh. John, Marquis of Tweeddale, Lord High Commissioner of Scotland became the first subscriber or Adventurer, as they became known.

There were initially 172 subscribers, 136 of whom lived in Scotland.

Records reveal that among them numbered 24 nobles, 39 landed proprietors, 41 merchants, 14 lawyers and judges and unusually for the time seven women who subscribed in their own right.

Altogether they raised a total of £1,200,00 Scots (£1000,000 sterling).

In 1995, the Bank of Scotland governor Sir Bruce Patullo wrote, “ The Bank has been visited periodically by plague and pestilence, it has experienced war and peace and has survived bouts of excessive rivalry.”

That rivalry became clear, shortly after the Bank took its first tentative steps, only a few weeks before Scotland’s parliament had breathed life into a project that Scots saw as the saviour of their nation.

The Disastrous Darien Scheme

A rising tide of support for the Darien Scheme saw vast sums of money pledged.

With so much money at its disposal, the company set up to oversee the scheme lent the funds out and issued its own notes.

By the middle of 1696, the intention of the Darien Company became obvious.

Its banknotes were widely distributed and the notes of the Bank of Scotland were accumulated so they could be presented all together with a demand for cash.

Darien’s tactics almost drove the Bank of Scotland out of business.

A bankrupt Scotland

It is probably now common knowledge that the Darien scheme collapsed with the loss of hundreds of thousands of pounds. Its legacy was a bankrupt Scotland.

The nation’s serious financial plight played a part in the push towards union with England. In the Treaty of Union (1707) the English government offered the Scots an ‘Equivalent’, a sum of £398,085 and 10 shillings to compensate them in a number of ways. The bulk however was used to repay the losses suffered by the Darien investors.

Equivalent Society, forerunner of the Royal Bank of Scotland

Many of the investors who received this payment joined to form the Equivalent Society.

The Society was subsequently renamed the Royal Bank of Scotland and received its charter on May 31, 1727.

The aims of the ‘New Bank’ were quite clear. Their goal was either to drive the Bank of Scotland out of business or to take it over on favourable terms.

To further quote Sir Bruce Pattullo on the history of the Bank of Scotland he said, “At times the tale is romantic and eventful. “

Perhaps even modern banking is still eventful but it is certainly less colourful. Battles are confined to the boardroom and romance is not something you would readily associate with the rather grey world of finance.

However, love banks or hate them, can we live without them?